The Definitive Guide to Medicare Graham

The Definitive Guide to Medicare Graham

Blog Article

What Does Medicare Graham Mean?

Table of ContentsGetting The Medicare Graham To WorkIndicators on Medicare Graham You Should KnowThe 2-Minute Rule for Medicare GrahamOur Medicare Graham IdeasThe Facts About Medicare Graham Uncovered

Before we speak about what to ask, let's discuss that to ask. There are a great deal of ways to register for Medicare or to get the information you require before choosing a strategy. For several, their Medicare trip begins straight with , the official web site run by The Centers for Medicare and Medicaid Solutions.

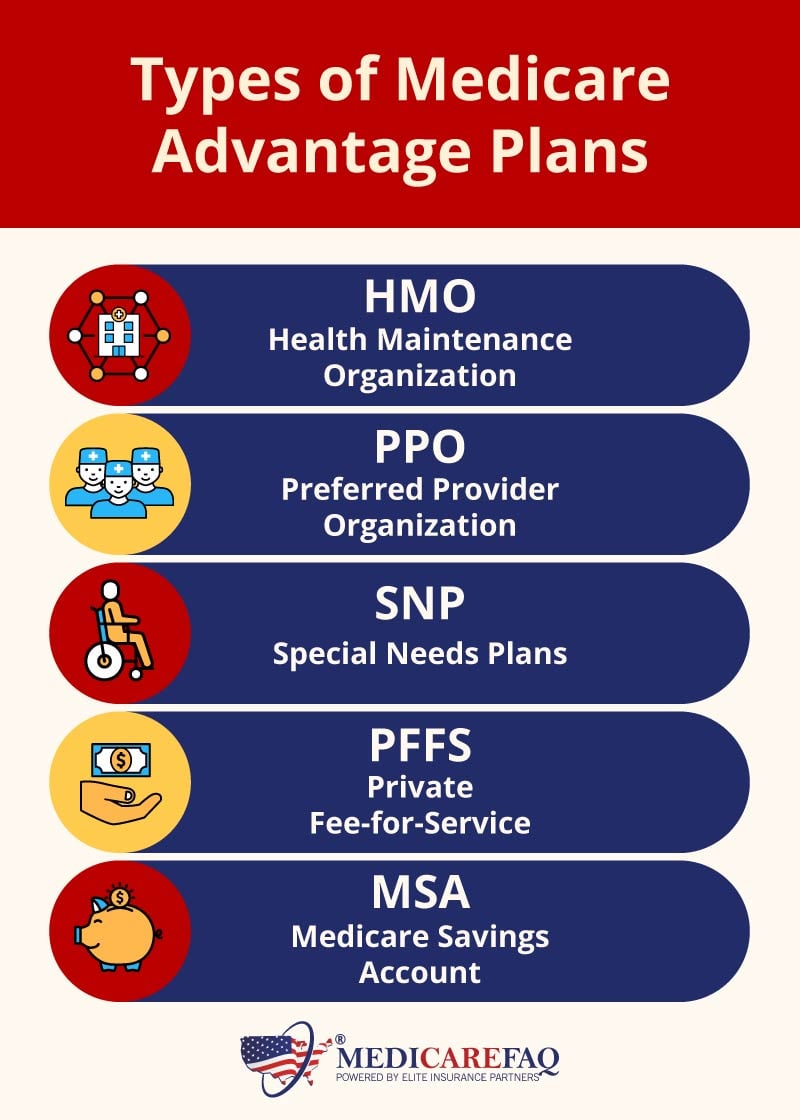

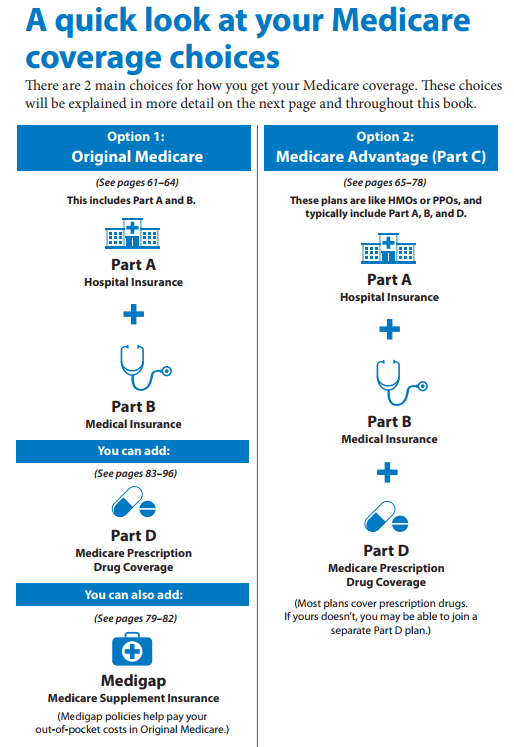

It covers Component A (healthcare facility insurance coverage) and Part B (medical insurance policy). This consists of points that are taken into consideration clinically essential, such as hospital keeps, regular physician brows through, outpatient solutions and even more. is Medicare coverage that can be bought directly from a private healthcare firm. These strategies function as an alternate to Original Medicare while using even more benefits - Medicare West Palm Beach.

Medicare Component D intends aid cover the price of the prescription medications you take at home, like your day-to-day medicines. You can enlist in a different Part D strategy to add medicine coverage to Original Medicare, a Medicare Price strategy or a few other kinds of strategies. For lots of, this is often the first concern considered when looking for a Medicare plan.

What Does Medicare Graham Mean?

To get the most economical wellness treatment, you'll desire all the solutions you make use of to be covered by your Medicare plan. Some covered solutions are entirely free to you, like going to the doctor for precautionary care screenings and examinations. Your plan pays everything. For others like seeing the physician for a remaining sinus infection or filling a prescription for protected anti-biotics you'll pay a cost.

, as well as coverage while you're taking a trip locally. If you plan on taking a trip, make certain to ask your Medicare consultant concerning what is and isn't covered. Maybe you have actually been with your existing doctor for a while, and you desire to maintain seeing them.

All about Medicare Graham

Several people who make the switch to Medicare proceed seeing their routine physician, however, for some, it's not that easy. If you're working with a Medicare expert, you can ask them if your medical professional will certainly be in connect with your new strategy. If you're looking at plans individually, you may have to click some web links and make some calls.

For Medicare Benefit strategies and Expense strategies, you can call the insurance provider to see to it the doctors you intend to see are covered by the plan you want. You can also inspect the strategy's site to see if they have an on-line search device to locate a covered physician or center.

So, which Medicare strategy should you select? That's the most effective part you have choices. And eventually, the option depends on you. Bear in mind, when getting begun, it is very important to make certain you're as educated as feasible. Begin with a list of factors to consider, make certain you're asking the right inquiries and start concentrating on what kind of strategy will best serve you and your demands.

All about Medicare Graham

Are you about to turn 65 and end up being freshly qualified for Medicare? The least expensive strategy is not necessarily the finest option, and neither is the most expensive strategy.

Also if you are 65 and still functioning, it's a great idea to evaluate your options. People receiving Social Safety advantages when transforming 65 will be automatically signed up in Medicare Parts A and B. Based upon your work circumstance and healthcare choices, you may require to take into consideration enrolling in Medicare.

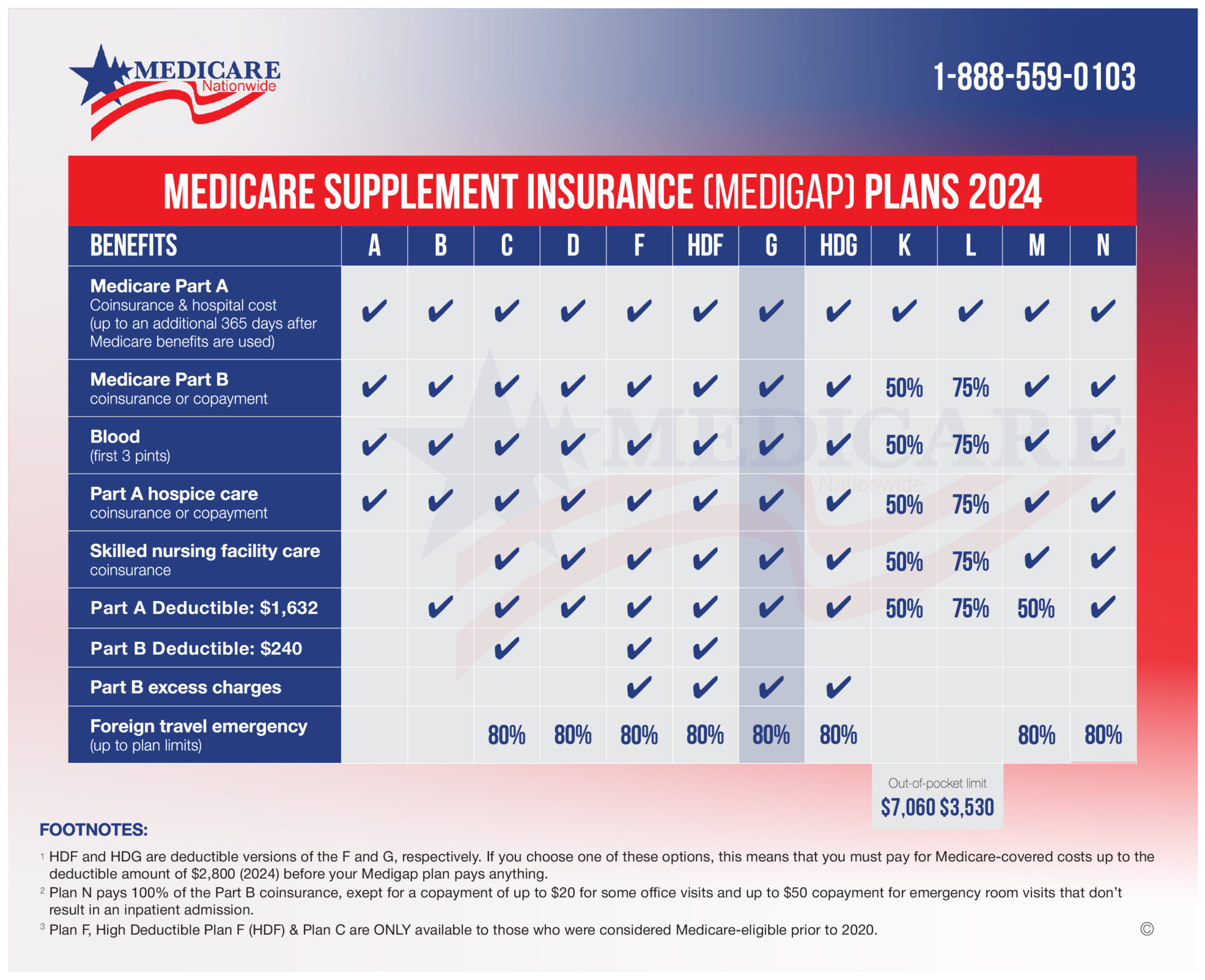

After that, think about the different kinds of Medicare intends available. Original Medicare has 2 parts: Component A covers a hospital stay and Component B covers clinical costs. However, lots of people locate that Parts A and B together still leave spaces in what is covered, so they acquire a Medicare supplement (or Medigap) plan.

Medicare Graham Things To Know Before You Get This

There is usually a premium for Component C policies in addition to the Part B premium, although some Medicare Benefit prepares offer zero-premium strategies. Medicare Lake Worth Beach. Testimonial the insurance coverage details, prices, and any fringe benefits supplied by each plan you're considering. If you enroll in original Medicare (Parts A and B), your costs and coverage will be the very same as various other people that have Medicare

(https://www.behance.net/billytaylor2)This is a set quantity you might have to pay as your share of the cost for care. A copayment is a set quantity, like $30. This is the most a Medicare Advantage participant will have to pay out-of-pocket for protected services annually. The quantity varies by plan, but as soon as you reach that restriction, you'll pay absolutely nothing for protected Component A and Component B services for the remainder of the year.

Report this page